are closed end funds riskier

The closed-end fund industry had more than 279 billion in assets under management at the end of 2020 but retail investors may not be familiar with this class of investment. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market.

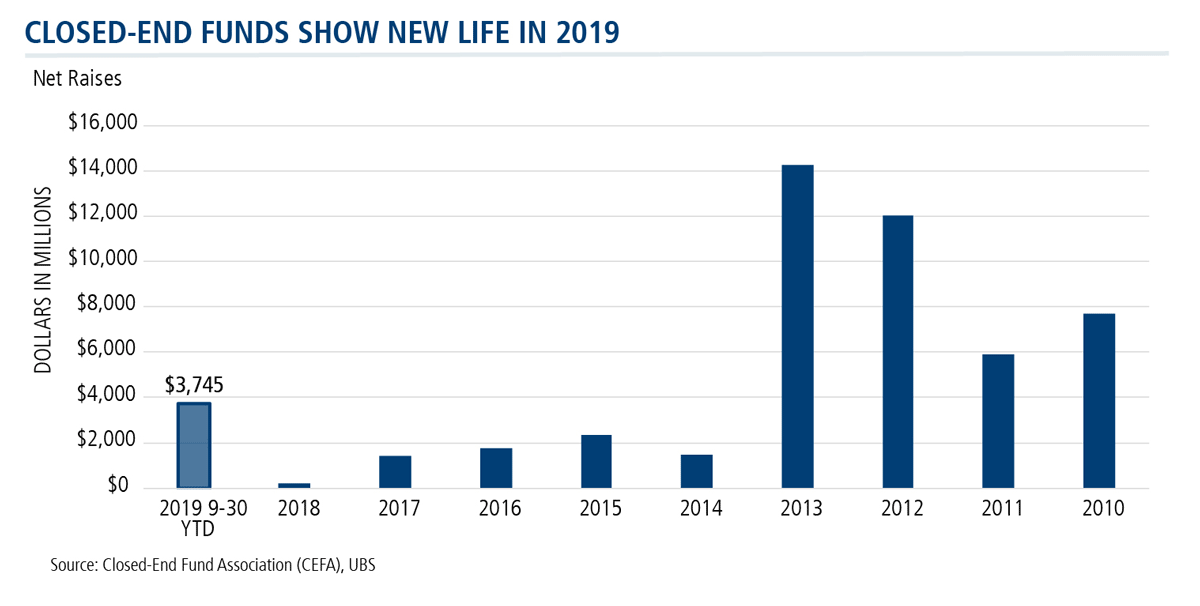

Why Are Yield Starved Investors Ignoring Closed End Funds Relative Value Partners

Generally theyre no riskier than their cousins open-ended mutual funds.

. If you are interested in learning about closed-end. A closed-end fund is a type of investment company that pools investor contributions together to buy a mix of securities such as stocks and bonds. Thats clear and should be stated again and again.

Closed-end assets are riskier than open-end assets which is fine for those with a long time horizon. Restricted and Illiquid Investments Risk. Certain closed-end funds may invest without limitation in illiquid or less liquid investments or investments in which no secondary market is readily.

The risky strategy can pay off when bets go the funds way but losses are magnified when investments go south. Some traditional mutual funds also. The average everyday investor should not own individual CLOs as they are too risky.

Many closed-end funds do. Investing in a closed-end fund that is selling at a premium is risky because it means the investors are paying more than the underlying assets are worth. Closed-end funds are much less common than open-end funds and they have some other features and risks not usually found in open-end funds.

The peculiarity of open-ended real estate funds is that in contrast to closed-end real. Institutional investors generally purchase CLOs. Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF.

Closed-end funds CEFs totaled 275 billion in assets at the end of 2017 compared to 187 trillion for the mutual fund industry as a whole according to the Investment. Closed end funds issue a set number of shares at the funds origin that trade on the stock exchange. The longer you plan on staying invested the longer you have to make up for.

Most closed-end funds are. Its assets are actively managed by the funds. Closed-end funds CEFs are actively managed registered investment vehicles that pool the money of many investors to buy baskets of securities providing access to.

CEFs are riskier investments compared to most other bond portfolios. Capital does not flow into or out of the funds when shareholders buy or sell. Puerto Rico Investors who purchased UBS Puerto Rico closed-end funds may have experienced a dramatic unexpected drop in the value of their accounts.

An open-ended real estate fund is an investment fund that invests primarily in real estate. If an investor owns CLO funds such an investment.

Why Closed End Mutual Fund Schemes Are A Risky Investment The Economic Times

7 Best Closed End Funds Of 2021

Guide To Closed End Funds Money For The Rest Of Us

What To Know About Buying Closed End Funds At A Discount Nuveen

Guide To Closed End Funds Money For The Rest Of Us

Investor Sentiment And The Closed End Fund Puzzle Lee 1991 The Journal Of Finance Wiley Online Library

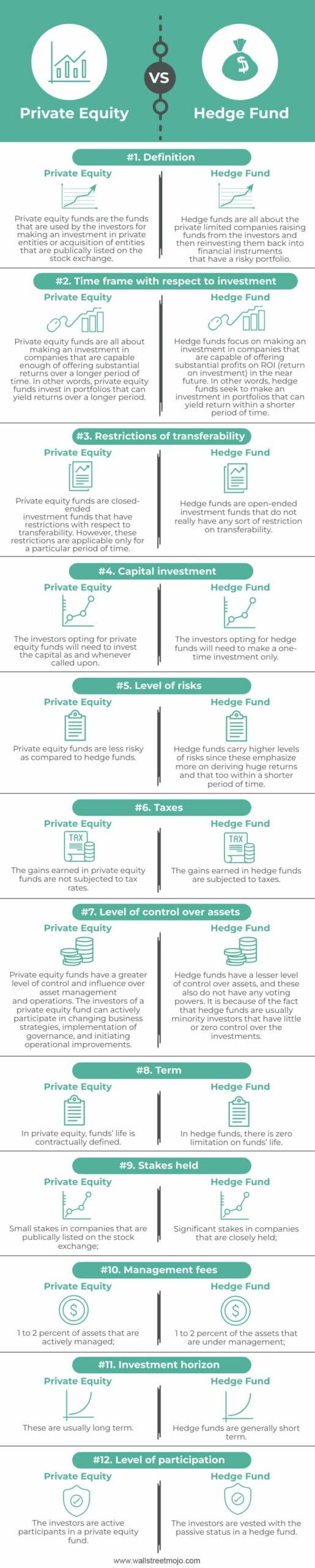

Hedge Funds Vs Mutual Funds The Motley Fool

Making Sense Of Closed End Funds Barron S

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

What Are Closed End Funds Fidelity

Managed Risk Portfolio Closed End Funds And Income Seeking Alpha

Private Equity Vs Hedge Fund 6 Differences You Must Know

5 Best High Yielding Closed End Funds To Buy

Understanding Closed End Fund Structures Nuveen

Closed End Funds 10 Examples Format Pdf Examples

Closed End Funds What They Are And How They Work

The Advantages And Risks Of Closed End Funds Aaii

Open Ended Fund Definition Example Pros And Cons

Closed End Funds What Are They Do They Belong To Your Portfolio